Business Transformation in Catastrophe Modelling

By Saloni Sharma, Manager | AInsurCo

Introduction

The insurance and reinsurance landscape is undergoing a significant technological shift, fuelled by the need to boost efficiency, simplify systems, and remain adaptable to evolving market demands. As part of this broader transformation, we partnered with a leading global insurer to help overhaul its catastrophe modelling and portfolio management systems.The aim was to modernise outdated tools, eliminate operational bottlenecks, and enable richer insights and reporting for key stakeholders. Although the project was eventually discontinued due to certain challenges, it offered invaluable insights that are already shaping future initiatives. In this article, our team member Saloni Sharma shares the objectives, approach, and lessons learned from the journey—along with the strategic value we brought to the table.

Why We Undertook This Project

Our client’s legacy catastrophe modelling and portfolio management systems were increasingly unfit for purpose. Key issues included:-

Outdated architecture that lacked scalability and flexibility

-

High manual effort causing inefficiencies

-

Limited functionality for regulatory and advanced reporting

With new compliance frameworks—such as those introduced by Lloyd’s of London—placing greater demands on transparency and reporting, the insurer recognised an urgent need to transform. Together, we set out to:

-

Streamline and modernise operational workflows

-

Enable better decision-making through advanced modelling tools

-

Improve reporting for regulatory bodies and internal stakeholders

Activities We Undertook

To drive this transformation, we undertook several critical activities:-

Decommissioning Legacy Systems

We supported the phased retirement of a portfolio management platform that had been in use for over 15 years. -

Implementing Modern Solutions

We introduced a bespoke pricing tool tailored to the client’s needs, featuring advanced algorithms capable of processing high volumes of data efficiently. -

Enhancing Existing Platforms

We upgraded downstream platforms to meet bespoke requirements and support regulatory submissions, with a focus on improving data flow and reducing manual tasks. -

Testing and Validation

We carried out extensive System Integration Testing (SIT) and User Acceptance Testing (UAT). Using detailed test cases, we simulated real-world scenarios—such as broker data analysis and portfolio roll-ups—to validate functionality and reliability.

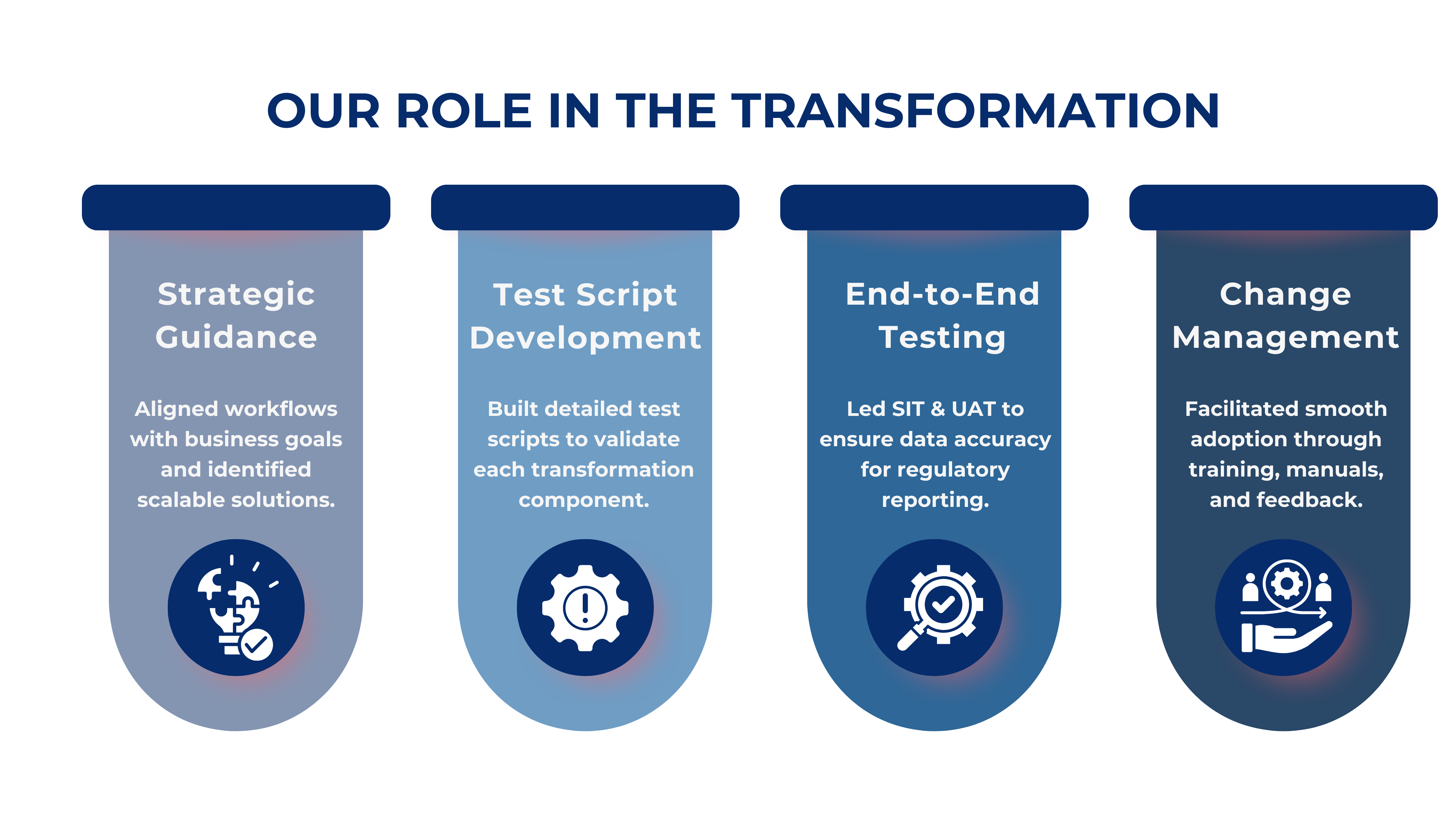

Our Role

We played a strategic role throughout the engagement, offering end-to-end support across four key areas:-

Strategic Guidance

We collaborated closely with the client’s teams to design workflows aligned with their business goals, identifying pain points and recommending scalable solutions. -

Test Script Development

We developed comprehensive test scripts to validate each component of the transformation, including exposure data migration from legacy to new platforms. -

End-to-End Testing

Our consultants led SIT and UAT processes, ensuring accurate data outputs—especially for Lloyd’s regulatory reporting. -

Change Management

We helped transition users to the new tools by conducting training sessions, providing user manuals, and gathering structured feedback for continuous improvement.

Key Takeaways

Although the project was ultimately discontinued, it yielded critical learnings that will guide future initiatives:-

Technological upgrades must be closely aligned with organisational readiness

-

Large-scale transitions carry inherent risks and demand careful planning

-

We identified opportunities to reduce manual processes by up to 40%

Business Benefits Delivered

Despite the tools not being fully implemented, the project produced several indirect yet valuable benefits:-

Improved Visibility

The initiative deepened the client’s understanding of its technology landscape. We identified several workflow bottlenecks—particularly in data migration. -

Refined Processes

Our efforts uncovered inefficiencies in data handling and reporting, laying the groundwork for automation that could save up to 30 hours per month. -

Better Risk Awareness

We highlighted risks and dependencies within the client’s legacy systems, enabling more robust contingency planning for future projects.

Client Outcomes

-

Actionable Strategic Insights

We provided meaningful insights into the client's operations and technology gaps, underscoring the value of cloud-based solutions for scalability. -

Stronger Foundation for Future Projects

The groundwork laid through workflows, scripts, and architecture will accelerate future transformation efforts. -

Enhanced Collaboration

The initiative improved alignment between technology teams and stakeholders, encouraging more cohesive and innovative problem-solving.

Lessons We Learned

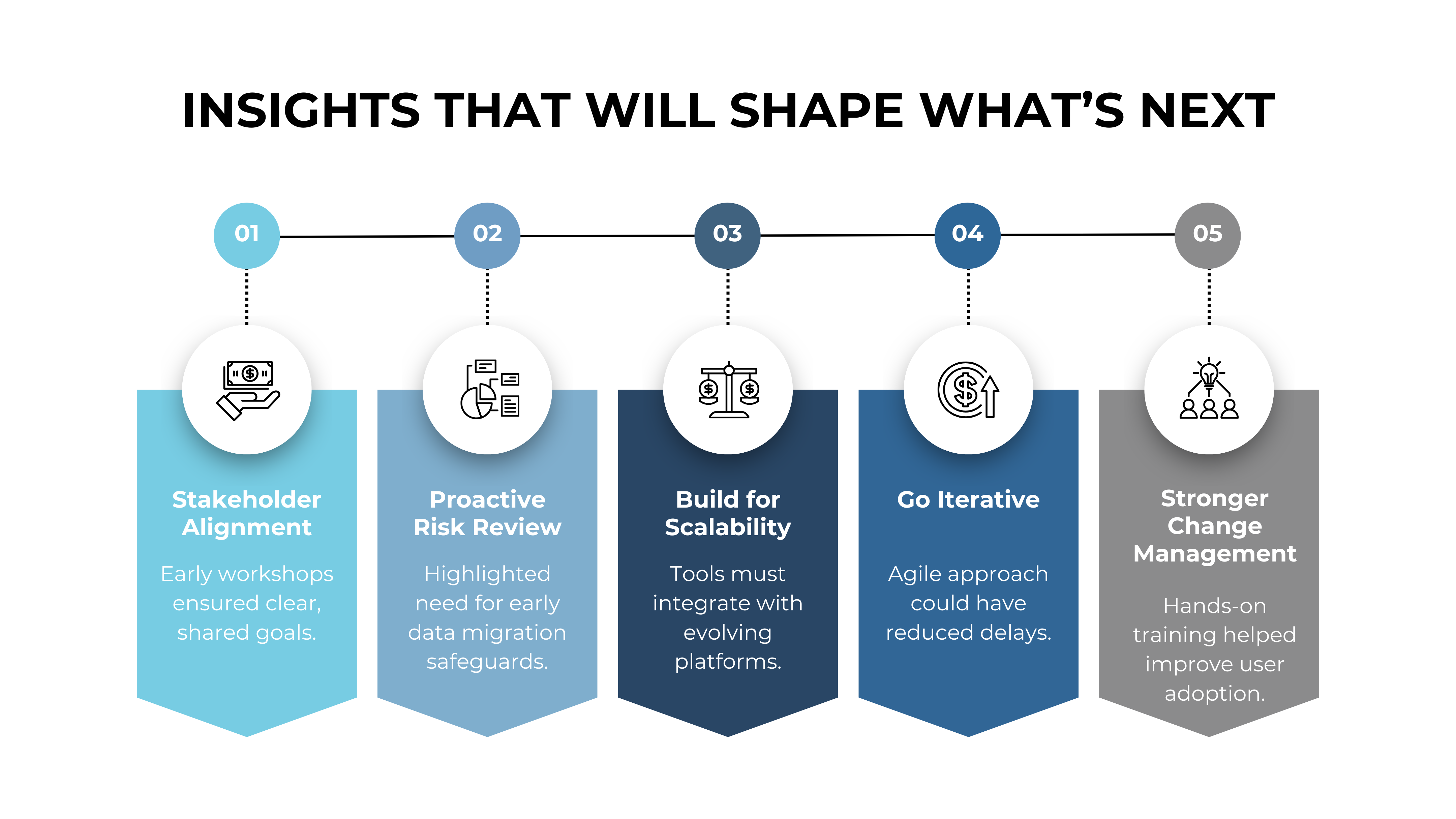

This project taught us several valuable lessons on managing complex business transformations:-

Stakeholder Alignment is Essential

We found that early-stage workshops helped ensure clear communication and shared expectations across teams. -

Risk Should Be Proactively Assessed

We now advocate for deeper risk reviews during the planning stage, particularly around data migration and fallback mechanisms. -

Scalability and Flexibility Must Be Built-In

Future tools should be designed to integrate seamlessly with third-party platforms and evolving data sources. -

Iterative Implementation is Preferable

An agile, phased approach could have helped identify issues earlier and reduce delivery risk. -

Change Management Needs to Be Robust

User feedback highlighted the value of hands-on sessions and peer support during transitions.

Looking Ahead

While this transformation didn’t reach completion, it set the stage for smarter, more effective initiatives. We remain committed to helping insurers navigate complex change, using our experience to deliver meaningful, long-term value.Going forward, we’re focused on:

-

Developing flexible, cloud-native catastrophe modelling platforms

-

Strengthening regulatory reporting tools

-

Empowering clients through AI-driven insights and enhanced analytics

Conclusion

We’re proud to have played a role in this bold transformation journey. Although the final outcome diverged from the initial vision, the knowledge gained will serve as a catalyst for future innovation. At AInsurCo, we continue to drive resilience, agility, and excellence across the insurance industry.

This article was authored by Saloni Sharma, Manager at AInsurCo.

To explore how we can support your transformation journey, get in touch with us at info@ainsurco.com.